In the third in a series of blog contributions throughout the year to complement the European Microfinance Award 2022 on 'Financial Inclusion that Works for Women', Marina Dimova from Women’s World Banking describes the importance of ‘women-centered design’ and outlines Women’s World Banking’s proprietary, five-phase approach to making financial products and services work for women.

The Problem

The Problem

Although nearly 250 million women in developing countries finally have some form of access to financial services, 742 million women – three times that many! – still have no access at all. To put this staggering number into perspective, if these women made up a country, it would be the 3rd largest country in the world. Furthermore, there are an additional 246 million women with inactive bank accounts, underscoring the fact that access to financial services does not always equate to usage.

These last 742 million women are the most difficult to reach for several reasons: they are typically located in rural areas with no connectivity or access to mobile phones and constitute the least educated and poorest demographic in their respective regions.

So, while those 250 million women are certainly cause for celebration, as Mary Ellen Iskenderian, President and CEO of Women’s World Banking puts it: “The global average hides the starker reality of the situation women face in many countries. In some countries it will take over 100 years to reach full inclusion without intervention.”

We cannot afford to wait 100 years to reach full inclusion. Unequal access to technology will continue to expose an already-vulnerable population of women to even more risks in the long term. To give just one example, the gender gap in smartphone ownership has widened to 18%, up from 15% in 2021, which translates to 315 million fewer women than men owning a smartphone.[1] To reach full financial inclusion for women, we must act now.

Why Design for Women?

Women’s financial needs are unique. For example, in emerging markets, unbanked women are 25% less likely than men to say they could use an account self-sufficiently.[2] And so, the financial solutions and products geared towards women should be just as unique as their needs.

While this idea is not new, the financial inclusion community has only recently begun evaluating how products are designed from a gender lens perspective. The emerging consensus has been that “one-size-fits-all” in fact means “one-size-fits-men.”

To bring a gender lens to designing financial products, Women’s World Banking has revamped the design process we use to better suit women’s needs, so that women, especially low-income women, are empowered to be part of the solution. This philosophy is what the financial inclusion community has begun calling “gender-intelligent design.”

The move towards gender-intelligent design has already produced several helpful resources, such as FinEquity’s “Incorporating Gender-intelligent Design in Financial Services.” However, one significant gap remains: a holistic, practical approach on implementing gender-intelligent product design.

The Solution – The Women-Centered Design Approach

At Women’s World Banking, we believe that when women leverage financial tools that are built to serve their specific needs, they can bring about the positive economic, social and political change needed in our fast-paced, volatile world.

To that end, we developed a women-centered design approach, a proprietary methodology to guide the development of financial products and services for the 742 million women around the world with little to no access to formal financial services.

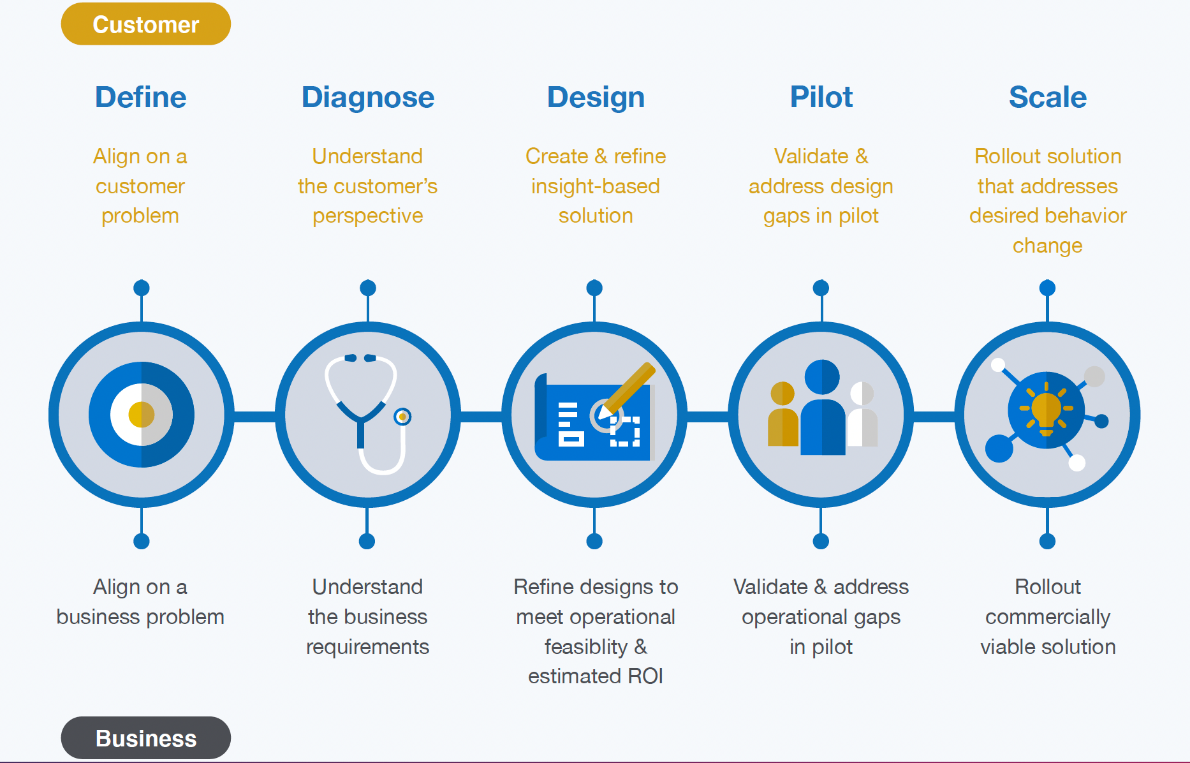

In essence, the women-centered design approach is a product development process that is inclusive, iterative, and adaptable to a constantly changing environment. The process features five key phases:

- In the Define and Diagnose phases, we define the problem that the solution aims to address and utilise customer research and business analytics techniques to understand its root causes.

- In the Design and Test phases, we develop the solution’s components and pilot them in a live environment to identify areas for further improvement.

- Finally, in the Scale phase, we create a product rollout roadmap and deploy the product at scale.

One characteristic that sets our approach apart is that it designs for two crucial stakeholder groups: women customers and financial services providers.

Both groups are equally important for the long-term sustainability of the financial products aimed to drive women’s financial inclusion. Designing for women customers lets us put the woman at the center, understand her needs and ultimately develop products that work for her and allow her to manage her financial life with ease and confidence. Similarly, designing for financial services providers helps us address their specific business and operational needs, while accounting for the financial viability and scalability of the solution.

And for financial services providers, there are clear benefits to utilising women-centered design. Implementing this approach allows providers to gain a clearer picture of where women customers are on their financial journey. This valuable insight makes it easier for providers to build products that empower women to take control of their financial lives, with the added benefit of boosting product adoption and usage rates.

Case Study – Activating the Use of a Digital Wallet among Factory Workers in Cambodia

Over the past few years, Women’s World Banking’s team has engaged financial services providers and financial inclusion practitioners in workshops and programs to share and teach our women-centered design approach.

We also leverage the women-centered design approach in our solution development advisory work. One such project is Women’s World Banking engagement with Network Member WING Cambodia to develop a solution to activate the usage of Wing’s digital wallet among women factory workers in Cambodia.

The women-centered solution that was developed and deployed is an account education and ‘learn-by-doing’ initiative that utilises a training session as the main touchpoint to teach women factory workers about their account and how to download and use the Wing app to conduct key use cases of interest to women customers, such as saving and sending money to family members.

What You Can Do to Empower Women Customers

What You Can Do to Empower Women Customers

All of us in the financial inclusion ecosystem have roles to play in helping close the gender gap in financial services.

We invite financial services providers around the world to commit to designing and deploying financial products that work for low-income women customers. And better serving women as customers can mean tapping into a $700 billion revenue opportunity.

Here are some ways you can contribute to women’s financial inclusion and leverage women-centered design right now:

- Join Women’s World Banking’s Global Network, the only financial services providers network focused on serving the low-income women’s market through facilitating insights-to-action and women-centered product design.

- Register to attend Women’s World Banking Making Finance Work for Women Summit on February 15-16, 2023, in Dubai, to engage with industry leaders and investors and explore what’s next for women’s financial inclusion.

- Subscribe to our mailing list and stay up to date on the latest developments in women’s economic empowerment, such as the launch of our women-centered design publication in Fall 2022.

Leave a comment