Thin - Filed and No - Filed individuals and emerging SMEs find it difficult to qualify for loans from financial institutions as they do not have previous banking history. Credit bureaus traditionally used the credit history of individuals or financial data of SMEs, such as, balance sheets and bank transactions for credit assessment. However, the traditional procedure is not applicable to previously unbanked individuals and new businesses; therefore, financial organizations face a time-consuming qualification procedure and find it challenging, often leading to lack of access to finance for such applicants. To avoid risk, these institutions and individuals are not considered as good borrowers and are not served, causing them to miss out on profit opportunities and triggering debt financing gaps. In India, this gap has been reported to be around $200 billion.

Thin - Filed and No - Filed individuals and emerging SMEs find it difficult to qualify for loans from financial institutions as they do not have previous banking history. Credit bureaus traditionally used the credit history of individuals or financial data of SMEs, such as, balance sheets and bank transactions for credit assessment. However, the traditional procedure is not applicable to previously unbanked individuals and new businesses; therefore, financial organizations face a time-consuming qualification procedure and find it challenging, often leading to lack of access to finance for such applicants. To avoid risk, these institutions and individuals are not considered as good borrowers and are not served, causing them to miss out on profit opportunities and triggering debt financing gaps. In India, this gap has been reported to be around $200 billion.

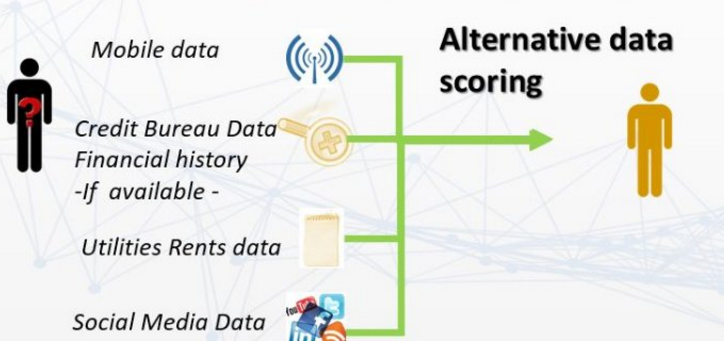

Financial institutions now use innovative technology to bridge the gap between emerging SMEs and new bank users by doing credit assessment through new techniques. Credit check without a credit history is carried out with Alternative Data- the use of non-financial payment history by adding transactions of alternative information in credit files. Previously viewed bad risk customers may now be considered high profit opportunities. The World Bank also encourages the use of Alternative Data and considers it a powerful tool for increasing access to finance and promoting financial inclusion.

Credit Scoring Systems based on Alternative Data have helped solve the problem of financial institutions. These systems enable institutions to increase their market and provide financial services to both SMEs and individuals with no credit background. Various types of non-financial information for analyzing the credit history of loan applicants include:

* Track record of utility bills, such as, electricity

* Mobile data including top-up and credit

* Rental payments

* Mobile phone remittances

* Social data

In these transactions, consumers utilize the service before and then pay the bills later. As these are of the same nature as credit, performance in these transactions is considered a good source for assessing the applicants.

The system is planned to benefit both the credit providers and loan borrowers. It enables financial institutions to carry out a reliable check and then give loans to the low-income clients. The institution can also reduce its credit risk while increasing the number of customers by reaching out to new markets. The use of Alternative Data also reduces the qualification time for loan approval for both the institution and the applicant.

The low-income community gets access to credit as the loan borrowing procedure is facilitated. Having loans enables them to take up entrepreneurial activities or pay off debts, thus leading to a decrease in world poverty. The SMEs can also benefit from alternative data based scoring systems, as they are able to qualify for the loans from financial institutions.

By Sidi Yasser El Jassouli, MFI Insight Analytics

Financial institutions now use innovative technology to bridge the gap between emerging SMEs and new bank users by doing credit assessment through new techniques. Credit check without a credit history is carried out with Alternative Data- the use of non-financial payment history by adding transactions of alternative information in credit files. Previously viewed bad risk customers may now be considered high profit opportunities. The World Bank also encourages the use of Alternative Data and considers it a powerful tool for increasing access to finance and promoting financial inclusion.

Credit Scoring Systems based on Alternative Data have helped solve the problem of financial institutions. These systems enable institutions to increase their market and provide financial services to both SMEs and individuals with no credit background. Various types of non-financial information for analyzing the credit history of loan applicants include:

* Track record of utility bills, such as, electricity

* Mobile data including top-up and credit

* Rental payments

* Mobile phone remittances

* Social data

In these transactions, consumers utilize the service before and then pay the bills later. As these are of the same nature as credit, performance in these transactions is considered a good source for assessing the applicants.

The system is planned to benefit both the credit providers and loan borrowers. It enables financial institutions to carry out a reliable check and then give loans to the low-income clients. The institution can also reduce its credit risk while increasing the number of customers by reaching out to new markets. The use of Alternative Data also reduces the qualification time for loan approval for both the institution and the applicant.

The low-income community gets access to credit as the loan borrowing procedure is facilitated. Having loans enables them to take up entrepreneurial activities or pay off debts, thus leading to a decrease in world poverty. The SMEs can also benefit from alternative data based scoring systems, as they are able to qualify for the loans from financial institutions.

By Sidi Yasser El Jassouli, MFI Insight Analytics