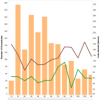

I’ve been poring over the data collected by the Angelucci, Karlan & Zinman study of Compartamos clients. To recap from my previous blog, with an average monthly loan payment of 2,100 for the loans in the study (and for Mexican MFIs generally), the figure of 1,572 pesos as the average client income poses a seemingly impossible debt-to-income ratio of 130%.

- COVID-19

- News

- Blog

- Resources

- Latest publications

- Action Group publications

- European Microfinance Week

- European Microfinance Week 2019

- European Microfinance Week 2018

- European Microfinance Week 2017

- European Microfinance Week 2016

- European Microfinance Week 2015

- European Microfinance Week 2014

- European Microfinance Week 2013

- European Microfinance Week 2012

- European Microfinance Week 2011

- European Microfinance Week 2010

- European Microfinance Week 2009

- European Microfinance Week 2008

- Briefs

- Conference Reports

- European Dialogues

- European Microfinance Award

- Newsletters

- Other

- Other Action Group Publications

- Trainings & webinars

- Videos

- e-MFP Activity Reports

- Action groups

- Advancing Refugee Finance Action Group

- Better Metrics for Effective Savings Action Group

- DIGITAL INNOVATIONS FOR FINANCIAL EMPOWERMENT

- From Research to Practice

- Green Inclusive & Climate Smart Finance

- Human Resources Action Group

- Investors

- Investors in Tier 2/3 MFIs

- Making microfinance investment responsible

- Remittances

- Research in microfinance

- Rural outreach & innovation

- University meets microfinance

- Youth financial inclusion

- WASH Action Group

- Microfinance week

- European Microfinance Week 2024

- European Microfinance Week 2023

- European Microfinance Week 2022

- EUROPEAN MICROFINANCE WEEK 2021

- European Microfinance Week 2020

- European Microfinance Week 2019

- European Microfinance Week 2018

- European Microfinance Week 2017

- European Microfinance Week 2016

- European Microfinance Week 2015

- European Microfinance Week 2014

- European Microfinance Week 2013

- European Microfinance week 2012

- European Microfinance week 2011

- European Microfinance Week 2010

- European Microfinance Week 2009

- European Microfinance Week 2008

- Award

- European Microfinance Award 2024

- European Microfinance Award 2023

- European Microfinance Award 2022

- European Microfinance Award 2021

- European Microfinance Award 2020

- European Microfinance Award 2019

- European Microfinance Award 2018

- European Microfinance Award 2017

- European Microfinance Award 2016

- European Microfinance Award 2015

- European Microfinance Award 2014

- European Microfinance Award 2012

- European Microfinance Award 2010

- European Microfinance Award 2008

- FI Compass

- Other activities

0