Improved liquidity position allows financial service providers to focus on pandemic recovery

The Covid-19 pandemic is the latest crisis that is putting pressure on financial service providers (FSPs) globally. Lockdowns and regulatory moratoriums on loan repayments, together with a lower business activity are putting serious constraints on FSP’s liquidity positions. Early in the Covid pandemic, there was widespread concern that liquidity constraints could wipe out many of the financial institutions that serve low-income customers and small- and medium sized enterprises.

The Covid-19 pandemic is the latest crisis that is putting pressure on financial service providers (FSPs) globally. Lockdowns and regulatory moratoriums on loan repayments, together with a lower business activity are putting serious constraints on FSP’s liquidity positions. Early in the Covid pandemic, there was widespread concern that liquidity constraints could wipe out many of the financial institutions that serve low-income customers and small- and medium sized enterprises.

Two recent reports issued by CFI/e-MFP and CGAP point to the vital importance of managing liquidity in the midst of a crisis. As the CFI/e-MFP report puts it: After all, the quickest path to failure of an FSP is running out of cash. Available liquidity should be used to retain the confidence and trust of both customers and creditors while continuing to operate and paying staff. Once stability is achieved, an FSP can start its recovery, but this cannot be achieved without retaining the confidence of customers, investors, staff, and the regulator.

Evidence of successful crisis response

Scale2Save is a partnership between WSBI and the Mastercard Foundation to establish the viability of small-scale savings in six African countries. To analyse the impact of the Covid crisis on the liquidity profile of our partner FSPs, we compared the pre-crisis liquidity position at end of year 2019 with that at end of 2020 when a cautious and gradual recovery of the Covid pandemic had set in. Across our programme partners, we collected liquidity gap reports from four banks and three deposit taking microfinance institutions in four countries: Ivory Coast, Nigeria, Morocco, and Uganda.

Liquidity risk arises from both the difference between the size of positions of assets and liabilities and the mismatch in their maturities. When the maturity of assets and liabilities differ, an FSP might experience a shortage of cash and therefore a liquidity gap. A liquidity gap report profiles assets and liabilities into relevant maturity groupings based on contractual maturity dates and is an important tool in monitoring overall liquidity risk exposure. A liquidity gap report is a standard disclosure included in audited financial statements of our project partner institutions.

Increased customer deposit balances

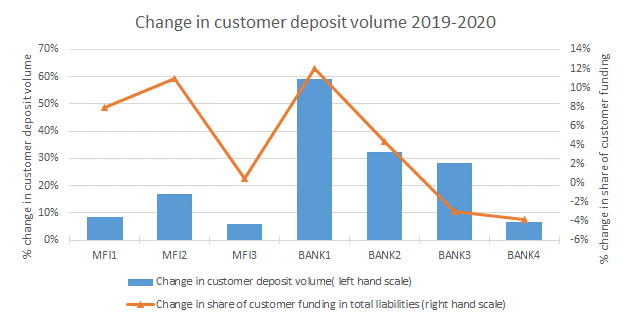

All partner financial institutions increased their customer deposit volume at the end of 2020 compared to pre-Covid crisis level. Perhaps more importantly, they also mostly managed to increase the proportion of customer deposit funding as part of total liabilities, as seen in the graph below.

The partner banks seem to have been more successful in increasing deposit volume compared to microfinance institutions. However, caution needs to be taken in generalising this conclusion as country and institution specific factors are also at play.

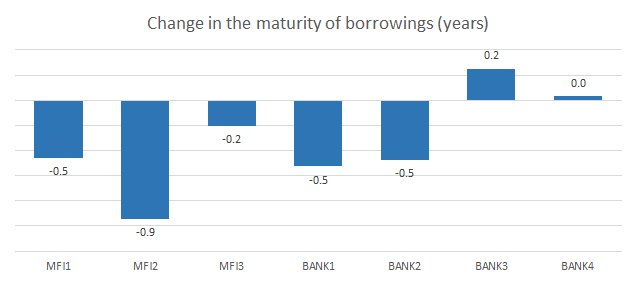

Lower dependency on borrowed funds

International creditors have been very supportive to banks and microfinance institutions during the Covid crisis, granting waivers for breaches of loan covenants, providing for temporary suspensions of interest and loan repayments, restructuring of loan terms and new financing. However, given the ample liquidity available from customer funding and the higher cost associated with international borrowings and debt issuance, most partner institutions chose to run-off these borrowings during 2020 lowering the proportion of borrowings in the funding mix. The average maturity of outstanding debt dropped as a result, as the following graph reveals.

Improved liquidity profile

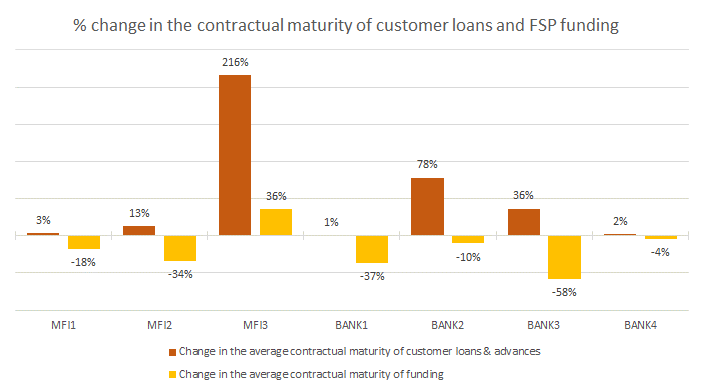

The maturity of customer loans and advances increased during the crisis due to loan moratoriums and the related rescheduling and restructuring. The loan maturity loan terms of all partner FSPs extended, with one example of a 216% increase, seen below, in the case of an institution which generally has extremely short loan maturities.

On the liability side, contractual maturities of funding decreased for all partner FSPs, except one. This was mainly the result of international borrowings that expired or that were not rolled over.

When considered from the perspective of contractual maturities, the combination of lengthening loan terms and shorter funding maturities would suggest a worsening of the structural liquidity position of an FSP. However, the anticipated maturity of retail customer current accounts, security and savings deposits is often much longer than their contractual maturity, when taking into account the behavioural characteristics of a large and diversified pool of individual accounts that exhibit “stickiness”. Only a proportion of these retail customer balances will be drawn down on contractual maturity date and the entire pool provides a more stable, long-term source of funding.

This point can be illustrated with reference to the international liquidity standards issued by the Basel Committee on Banking Supervision for the calculation of expected cash outflows for two key liquidity risk indicators, the liquidity coverage ratio (LCR) and the net stable funding ratio (NSFR). The Basel standards assume that between 3% and 10% of retail deposits[1] would actually run-off over the next 30 days under an adverse liquidity scenario. The corollary of this is that 90-97% of retail deposit funding can be considered to be stable in nature and of longer duration. As short-term customer account funding (<30days) of our partner institutions make up a significant proportion of the total customer funding (between 30% and 90%), a large part of these funds can therefore be considered as “core” and provide a stable funding base to compensate for the extended loan maturities from Covid impacted loan rescheduling.

The Basel global liquidity standards are meant as guidance and FSPs operating in less developed markets and more volatile environments may experience higher deposit run-off rates in case of liquidity stress. Nevertheless, a significant proportion of our partners’ customer account and savings balances can be considered as stable.

Institutional resilience in face of the Covid crisis

At the outset of the Covid crisis, our partner institutions invoked their pandemic crisis management plan and took protective measures for customers and staff to prevent infection and transmission. Partner institutions granted credit relief to borrowers in the form of loan moratoriums in line with regulatory forbearance measures. Digital access to customer accounts was stepped up, so customers could meet household consumption expenditure during the lockdown.

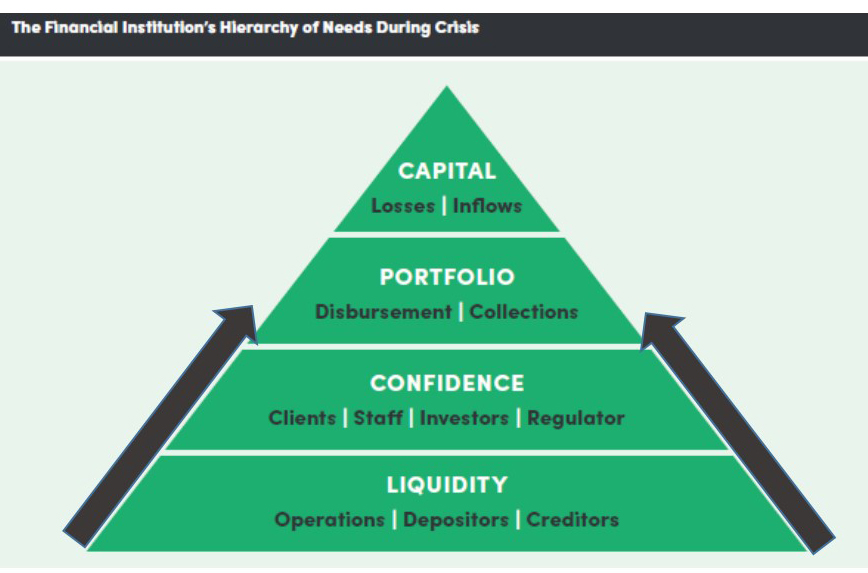

Our partners have withstood the liquidity stress induced by the Covid crisis and successfully retained the confidence of customers and investors. With a cautious and gradual recovery from the Covid pandemic underway, FSPs can now focus on recovery steps higher up the hierarchy of financial institutions crisis management needs. These needs were described in the CFI/e-MFP report in the following order of priority: liquidity, confidence, portfolio and capital.

(Diagram reproduced with permission from the “Weathering the Storm II – Tales of Survival from Microfinance Crises Past” report published by Center for Financial Inclusion and The European Microfinance Platform,)

With stability restored, FSPs can now shift their recovery efforts to managing the loan portfolio by balancing collections of overdue loans with the need to continue lending to reliable low-income customers and small- and medium-sized enterprises and maintaining capital adequacy levels when Covid-related regulatory forbearance measures will expire.

Through surveys and case studies the Scale2Save programme continues to investigate the driving factors that influence the different outcomes of Covid crisis management.

[1] The 3% minimum norm would apply in the case of retail account balances covered by deposit insurance schemes to 10% in the case of high value deposits, foreign currency deposits or deposits that can be withdrawn quickly online

Leave a comment