When we at WSBI set out its Scale2Save Programme in 2016, we anticipated that customer centricity was a challenge for savings and retail banks in Africa. The programme’s first-ever study, State of savings and retail banking Africa, released earlier this year, has proven that to be true. Based on responses to a survey of 34 WSBI Africa member institutions, the study shows that making small-scale savings work requires both more thought on the supply side, and a better acknowledgement of the needs of people – the demand side – too.

When we at WSBI set out its Scale2Save Programme in 2016, we anticipated that customer centricity was a challenge for savings and retail banks in Africa. The programme’s first-ever study, State of savings and retail banking Africa, released earlier this year, has proven that to be true. Based on responses to a survey of 34 WSBI Africa member institutions, the study shows that making small-scale savings work requires both more thought on the supply side, and a better acknowledgement of the needs of people – the demand side – too.

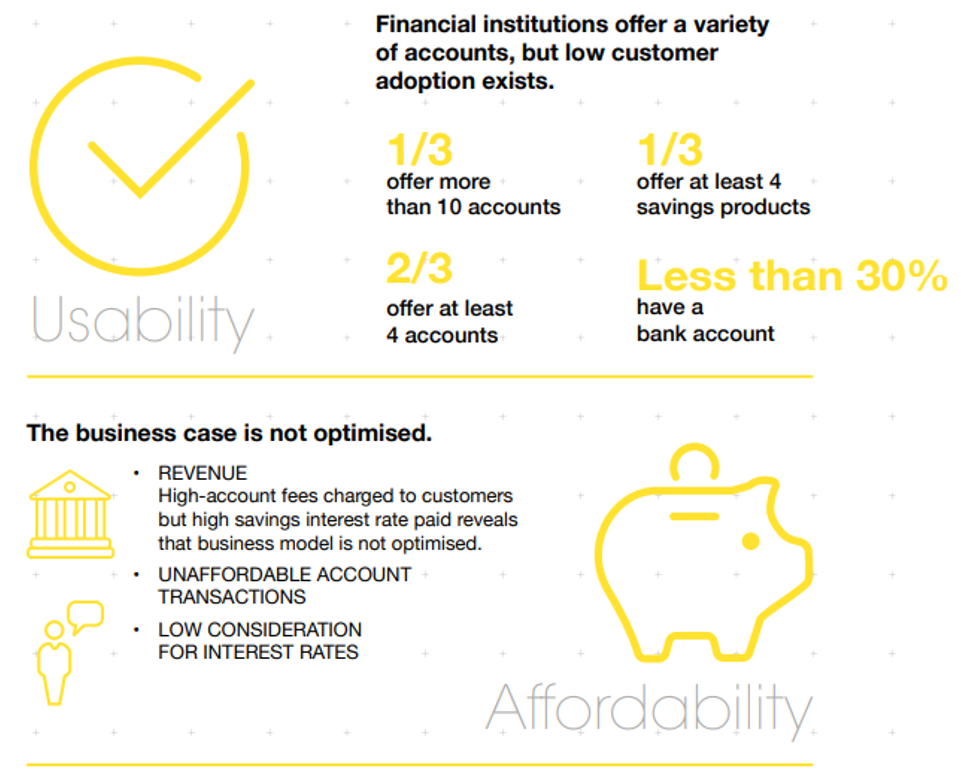

The 50-page report is part of the research component of Scale2Save – a partnership between WSBI and Mastercard Foundation – and reveals that member banks offer an array of transaction and savings accounts as part of their drive to attract and satisfy customers. The infographic below sheds some light on just how active banks are to push out products, but also the pitfalls and challenges when it comes to the four pillars that frame the report: usability, accessibility, affordability and sustainability.

|  |

As the survey results focus on supply-side (that is to say, banks’) perceptions of customer centricity, it reveals that the product and service mix offered falls short. That shortfall can impair account activity and hamper take-up by potential customers. If this persists, these banks could see adverse effects on their financial performance, undermining what the Scale2Save programme seeks to achieve – increasing the viability of small balance savings in six African countries. WSBI banks offer a broad service, indeed, which shows a real commitment to widening financial access to low-income people, especially when it comes to women and those in rural areas.

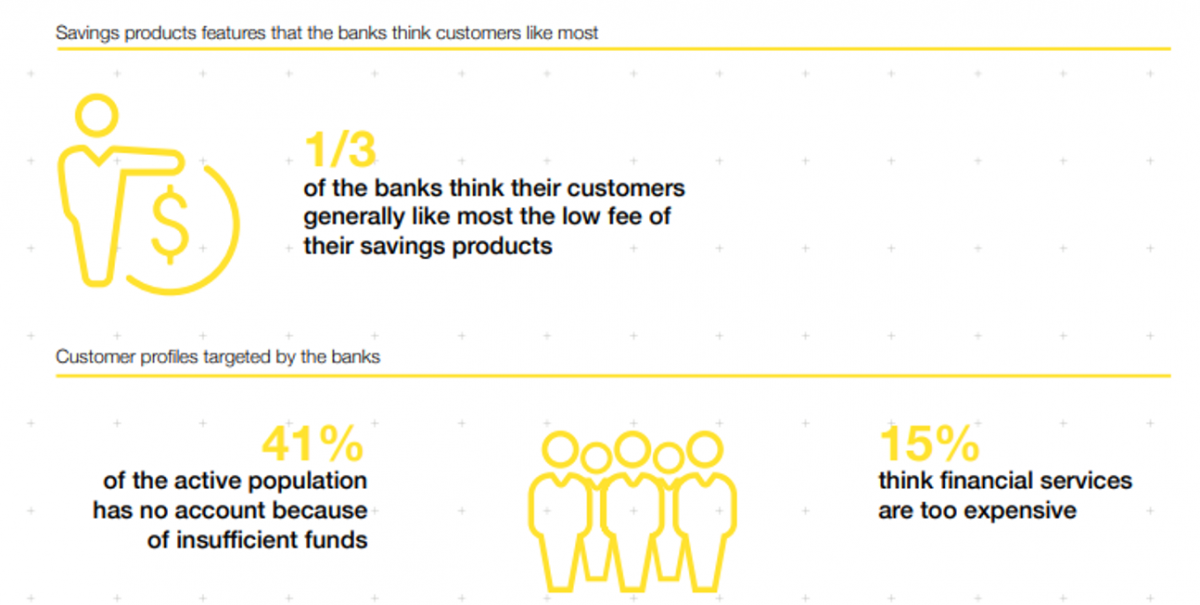

As we examined the data further, we found a persistent affordability gap, which makes it hard for low-income people to access financial services. Two in five people in Sub-Saharan Africa live on less than the internationally recognised poverty line of US$1.90 a day (in 2011 prices). Any business case that weaves in high account charges for maintenance of those accounts is bound to fail for this segment of the population. The chart below illustrates how banks view customer perception of what customers like most: low fees. That makes sense. We also see that a big proportion of targeted customers have no account because of insufficient funds. It seems customers have expressed some concern about financial services being too expensive.

High-tech accessibility hampered by start-up costs; customer reach suffers

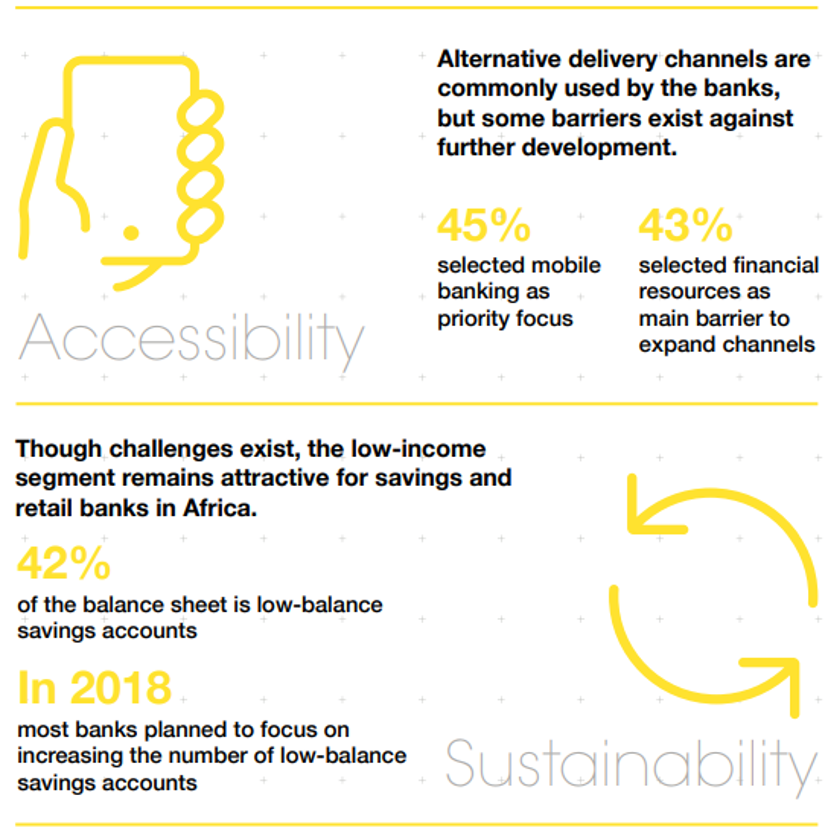

Survey results show an appetite among respondents to scale-up alternative delivery channels for financial services, such as through ATMs, agents and mobile phones. Half of them use agents and mobile banking. Some 45% of respondents remain interested in investing in mobile banking. Designed to make it easier for customers to carry out banking, alternative channels have a costly price tag that weighs down on the already limited operating budgets of banks. Banks see upfront investment costs as an especially heavy burden, while there is neglect on outlays for continuous training and monitoring.

As mobile banking continues to explode in Africa, WSBI member banks will need to spend more on digitally driven platforms. To keep costs in check and speed up service delivery, banks are considering partnering with mobile network operators or new entrants such as FinTech companies.

Anecdotal information goes beyond data

Results of the report echoed first-hand accounts by financial institutions at the Peer Review Workshop held in March. That gathering brought together people from the six Scale2Save projects in Kenya. Held with the help of Kenya Post Office Savings Bank (KPOSB), which is both a WSBI member and project partner, and with the support of its Managing Director Anne Karanja, the event was an opportunity to hear a wide variety of participants’ anecdotes via first-hand accounts of customer centricity struggles with the six Scale2Save projects. One account by a financial institution revealed the caution institutions must exercise in approaching customers around insurance, as they may wonder if you want them dead. Take-up of an account requires care on the supply side, indeed.

Customer experience was also discussed during one panel. Experts advocated the need for investment in organisational structures and highlighted the need for putting internal structures in place to support customer centricity.

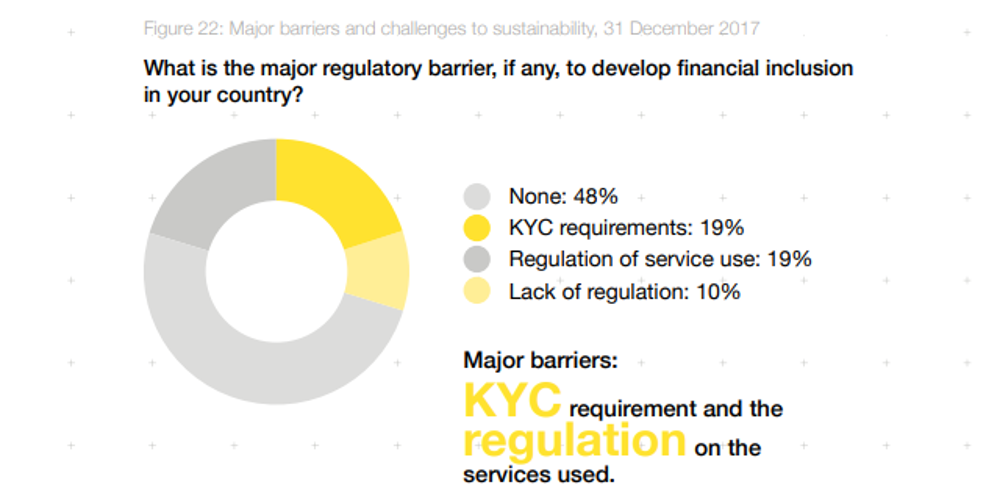

Regulation was one report finding that echoed throughout the workshop sessions. The 40 attendees shared differing approaches to banking rules in the region. A lot of frustration bubbled up around regulation thwarting financial inclusion, especially when it comes to accessibility. One example was a rule requiring Interpol clearances in Uganda for thousands of agents there – no small task, indeed. In Kenya, it seems Tax ID, or tax registration rules, may hinder more account take-up as well. Searching the right role for government when it comes to digitisation is crucial. They have a role indeed, but how are they going to help drive digital-driven financial inclusion without hindering it? The chart below presents the 34 WSBI institutions’ response to question on regulatory barriers.

One question that persists is: why isn’t anyone here talking about open banking? It’s coming, it’s already here. From M-PESA to M-KOPA, they have opened up. So much of the conversation in banking is about open banking and APIs, and regulators need to tackle the customer protection side. Questions around who is liable should also be addressed. As WSBI’s Weselina Angelow observed during the workshop, the move from cash to digital for customers is a challenge. Even in the host country Kenya, the birthplace of M-PESA, it’s clear how much of a lifeline it is for people throughout the country. It’s evident too that KPOSB taps into M-PESA to move money from village group savings boxes placed in member homes into POSTBANK accounts for safeguarding.

What we learned so far

Bank organisations must reform their business models. That means greater customer-focused bank leadership and culture to help improve the customer experience when opening an account and actually using it. Doing so would allow banks to satisfy customers more, which leads to more sustainable services from the banks themselves.

Shying away from it ultimately drains the bottom line for banks, and the long-term prospects for bringing to market financial services for poorer people. That means coping with razor thin margins and cost-cutting moves on the bank operations side, balanced with the need on the demand side for convenient, secure, affordable and accessible products and services that deliver value for people.

Shying away from it ultimately drains the bottom line for banks, and the long-term prospects for bringing to market financial services for poorer people. That means coping with razor thin margins and cost-cutting moves on the bank operations side, balanced with the need on the demand side for convenient, secure, affordable and accessible products and services that deliver value for people.

But if banks in Africa, like anywhere, maintain too much of a product-led focus, then expect slow take up of basic accounts, high account dormancy rates, and banks struggling to remain a sustainable business in this growing, vibrant and younger-aged marketplace.

Photo: Ian Radcliffe (centre) discusses KPOSB’s Scale2Save project with workshop participants

Leave a comment